Financial Services

How Is AI Governance in Financial Services Being Automated?

AI governance in financial services is no longer manual. Today, automation simplifies documentation, centralizes risk management, streamlines vendor oversight, and strengthens compliance workflows—helping financial institutions scale AI safely and responsibly.

See How We Support Leading Financial Services Organizations

Organizations trust FairNow to maximize their AI while minimizing their risk.

See How We Support Leading Financial Services Organizations

Organizations trust FairNow to maximize their AI while minimizing their risk.

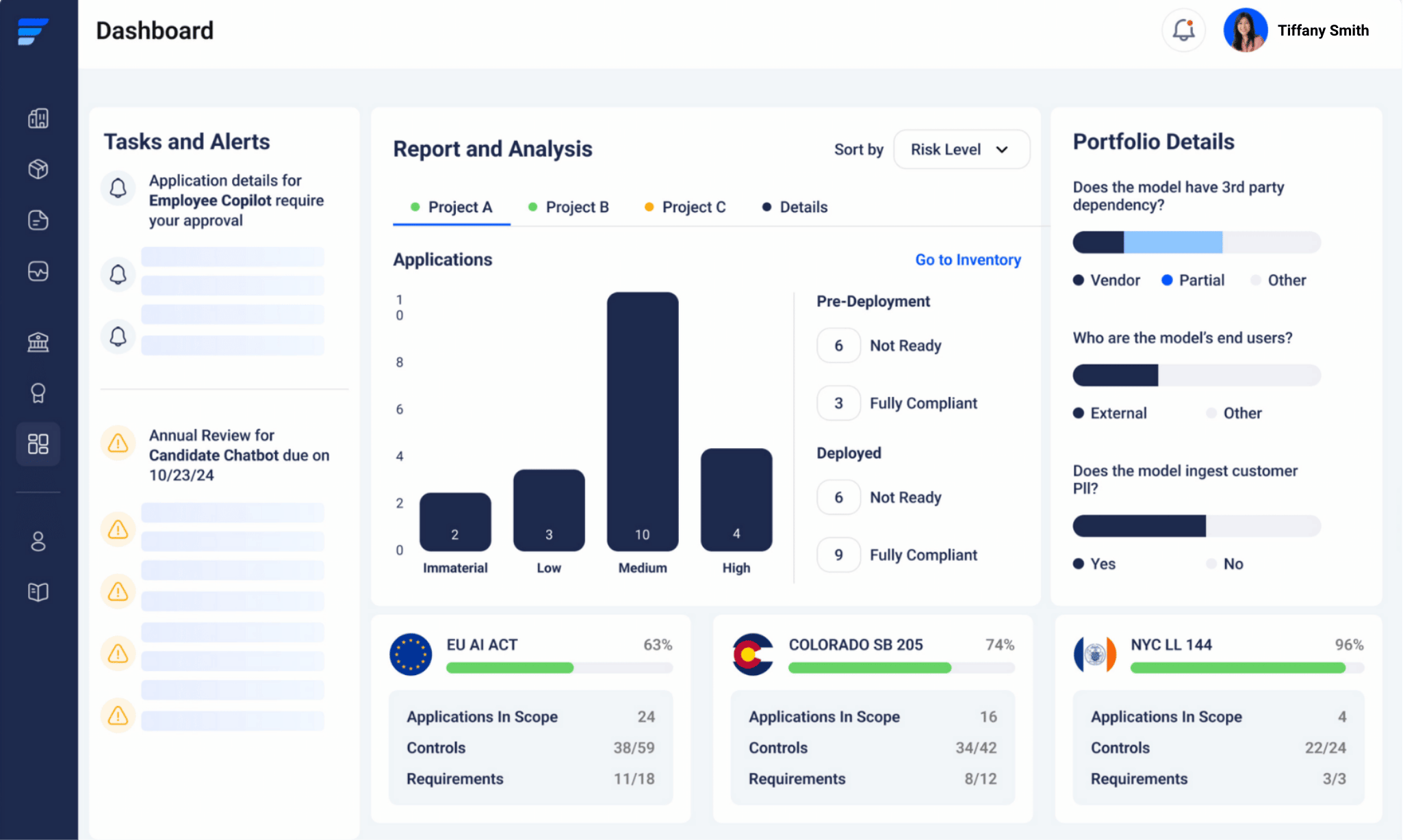

Centralize AI Governance Management

Assign clear roles and responsibilities to streamline collaboration

Boost efficiency and eliminate redundancy through process automation

Automatically generate initial AI policies and risk evaluations

Automate Documentation

Automatically generate first-pass drafts of model documents, formatted to your specifications

Automatically capture detailed audit trails

Collect all of your artifacts, documents, and audit logs in one place

Manage And Mitigate AI Compliance Risks

Utilize built-in compliance frameworks to align with global regulatory standards

Receive alerts on regulatory changes and automatically notify team members

Demonstrate compliance to build trust with clients and regulators

Simplify AI Vendor Risk Management

Easily inventory and assess the AI risk of all vendor models

Centralize and standardize the process of collecting and storing governance evidence

Validate that vendors meet your requirements using FairNow's risk assessments

Explore the leading AI governance platform

AI Governance FAQs

An AI Governance Platform Built for Financial Services

What is AI governance in financial services?

AI governance in financial services can complement existing model risk management (MRM) programs. But in some ways, AI governance expectations will extend beyond existing practices and mandates of model development and model validation groups. When designing an approach to AI governance, it is important for financial services institutions to consider how AI governance activities will relate to their existing model risk management programs.

Similarities between AI Governance and Model Risk Management (MRM)

Many new laws focused on AI require risk management programs with model testing, monitoring, and validation components.

These requirements align well with existing regulatory standards like SR 11-7 (US) and OSFI E-23 (Canada). Concepts introduced in new AI laws – including risk-based approaches to model review – are already common for financial services institutions.

Key Differences Between AI Governance and MRM

In addition to traditional MRM expectations, multiple new AI regulations layer on requirements that would typically fall outside a traditional model development or validation team’s scope. Examples include certain transparency requirements (for example: disclosures to users of an AI system, or public postings on a company’s website) and record-keeping stipulations.

New GenAI technologies can also pose threats to data privacy and cybersecurity that may require AI governance teams to bring in reviewers from other parts of the organization. Because of these differences, AI governance standards can introduce new complexity.

What are the benefits of using AI governance software in financial services?

- Build Scalable Governance Workflows

- Adapt to the changing needs of your organization with a highly flexible platform.

- Manage All The Models You Build & Buy

- Create a centralized model inventory where all AI risk management activities can be managed in one place.

- Reduce Repetitive Documentation Requirements & Boost Efficiency

- Centralize and streamline all AI governance activities across the organization.

- Ensure Continuous Compliance

- Ensure adherence to regulatory requirements with automated monitoring and simplified reporting.

Why do financial services organizations invest in AI governance tools?

By streamlining governance workflows, maintaining comprehensive AI inventories, and automating documentation, AI governance tools help financial services organizations operate more efficiently and confidently in a highly regulated environment.

What is the cost of implementing an AI governance platform?

The cost of implementing an AI governance platform depends on the organization’s size, the complexity of its AI systems, and its specific compliance needs. FairNow provides scalable solutions tailored to various business sizes and requirements.

Provide details about your organization below for more info.

Which companies provide AI governance software for financial services?

FairNow offers AI governance software specifically tailored to the unique needs of financial services. FairNow’s AI governance platform provides enterprise-ready tools for highly regulated and global industries.

Companies depend on FairNow’s expertise in this sector to ensure their AI systems are unified, managed, and compliant with all current and impending regulations.